Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreKEY POINTS OF THE ARTICLE:

Currency Table-Time Horizon: Daily

|

bias |

resistance |

support |

comment |

|

|

bull |

80.72/84 |

78.8 |

Consolidation under resisatnce |

|

|

bull |

0.7814 |

0.764 |

Consolidation under resisatnce |

|

|

bear |

1,604 |

1.5685 |

Break restoreangle horizontal_Obj 1.5685 reached then 1.5350 |

|

|

neutral |

1.0877 |

1,066 |

||

|

neutral |

0.93 |

0.8865 |

Rebound on support |

|

|

neutral |

127.5 |

125.15 |

Bearish Divergence-Test Support |

|

|

bull |

1,255 |

1,201 |

Correction-Return on support |

|

|

bull |

142.72 |

137.2 |

Bullish bias >140.30 |

|

|

bull |

1.37 |

1.3285 |

Bullish oblique in support-Obj 1.3900 |

|

|

bull |

0.74 |

0.7 |

correction |

|

|

bear |

0.8920/85 |

0.87 |

Bullish Divergence-Stress Test 0.8920 |

|

|

bear |

104.75 |

101.18 |

Descending oblique test |

HIGHLIGHTS: THE MARKET IN SEARCH OF NEW CATALYSTS

The market reaction resembles the "Buy the rumor, sell the news" logic, as risk assets have risen sharply in anticipation of the Biden stimulus package announcement and now appear to be at a standstill as traders look for new catalysts to boost price action.

The dollar index hit a three-and-a-half-week high on Friday despite weaker-than-expected retail sales as weaker stocks boosted demand for liquidity for the dollar. The dollar also rose after the EUR/USD hit its lowest level in a month, amid fears that further restrictive measures in Europe could weaken economic growth in the eurozone. USD/JPY remained virtually unchanged on Friday.

The dollar is also boosted this morning by a wall street journal report that Treasury Secretary candidate Janet Yellen must affirm her commitment to determined exchange rates in the market.

EUR/USD fell to a one-month low on Friday as economic growth in Europe is likely to weaken, with France imposing a daily curfew at 6pm across the country, while Germany and Italy are looking to tighten and extend their lockdown measures. EUR/USD is still being penalised by political uncertainty in Italy after members of former Prime Minister Renzi's party left the coalition on Wednesday, leaving Prime Minister Conte without a majority in parliament. A new phase of political crisis cannot be ruled out.

USD/JPY remained unchanged and eventually ended with modest gains. A bearish factor for the yen was the announcement on Friday that Japan's November tertiary activity index unexpectedly fell -0.7% m/m, lower than expectations of +0.3% m/m, and the biggest decline in 6 months. Gains in USD/JPY were limited by higher Japanese government bond yields. The yield on Japanese 10-year bonds hit a high of 0.043% on Friday, which improved currency interest rate differentials with the yen. Weakness in equities on Friday also boosted demand for safe havens for the yen and was negative for the USD/JPY.

Ocean currencies have entered corrective mode, the AUD remains above an upside oblique without advancing while the NZD has broken an intermediate support at 0.7145 that could extend its correction without questioning the uptrend. This morning good growth figures in China could support ocean currencies.

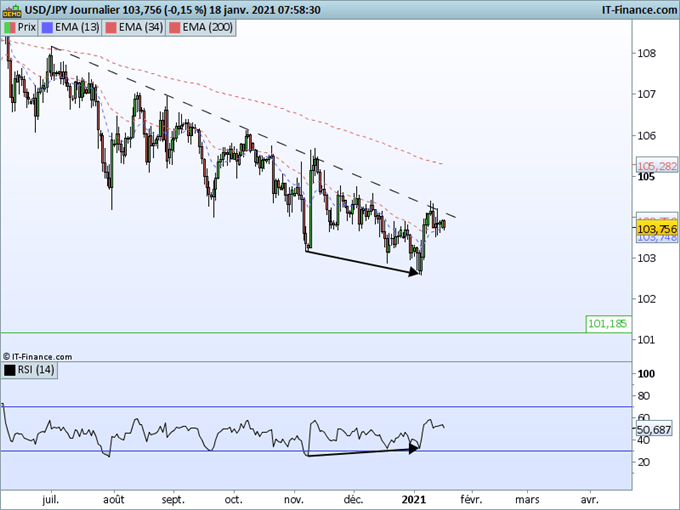

TODAY'S CURRENCY: THE DOLLAR'S REBOUND AGAINST THE YEN COMES UP AGAINST A BEARISH OBLIQUE

The yen dollar has been in bearish momentum since July. The bullish divergence allowed the greenback to regain height but the pair fails to cross the downward oblique with the manifestation of a reversal candlestick at its contact last Monday. Attempts to overflow during the week ended in failure.

Prices could therefore return to the south in the coming days with a target of 101.20 which corresponds to the low of the month of March during the Covid crisis. An overflow of the oblique would invalidate this scenario and allow a larger rebound towards the 200-period moving average at 105.28 currently.

Evolution of the dollar against yen in daily data:

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

16/06/2923 - Indice/Marchés

06/03/2026 - Indice/Marchés

06/03/2026 - Indice/Marchés

05/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

03/03/2026 - Indice/Marchés

16/06/2923 - Indice/Marchés

06/03/2026 - Indice/Marchés

06/03/2026 - Indice/Marchés