Les actualités de la BRVM en Flux RSS

Les actualités de la BRVM en Flux RSS

Nous agrégeons les sources d’informations financières spécifiques Régionales et Internationales. Info Générale, Economique, Marchés Forex-Comodities- Actions-Obligataires-Taux, Vieille règlementaire etc.

Enjoy a simplified experience

Find all the economic and financial information on our Orishas Direct application to download on Play StoreKEY POINTS OF THE ARTICLE:

Currency Table-Time Horizon: Daily

|

bias |

resistance |

support |

comment |

|

|

bull |

78.5 |

77.1 |

Crossing resistance in progress |

|

|

bull |

0.7677 |

0.75 |

Resistance crossed at 0.75 |

|

|

neutral |

1,642 |

1,607 |

Test support |

|

|

bear |

1.0877 |

1,066 |

Back to old support 1.0785 |

|

|

neutral |

0.915 |

0.8975 |

Stress test |

|

|

bull |

127.1 |

125.15 |

Horizontal consolidation |

|

|

bull |

1,255 |

1,201 |

||

|

neutral |

140.3 |

137.2 |

Horizontal consolidation |

|

|

neutral |

1.35 |

1.3285 |

correction |

|

|

bull |

0.7075/7100 |

MM13 |

Stress test |

|

|

bear |

0.8985 |

0.87 |

||

|

bear |

104.75 |

103.68 |

Consolidation between the two terminals |

GENERAL CONTEXT: BREXIT AND US NEGOTIATIONS DRAG ON

The book is being held this morning because the game is not over. The European Union and the United Kingdom have agreed to continue negotiations on trade agreements beyond yesterday's deadline. A call between British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen has given new impetus to the drive to reach an agreement, with both sides saying they will go "the extra mile". So new hope for the British currency and optimism returns... the saga continues

Extension also in the United States of one week this time. In the U.S., lawmakers are expected to pass a week-long spending law to fund the government, but the House has indicated that any other bill would require agreement on a broader fiscal stimulus package. Unfortunately, very little progress has been made and Senate Republicans say they have no majority support for the current bill. If a deal can't be reached within a week or two, we could see strong year-end losses on currencies and stocks.

The concern is that December 31 will be a horrible day for many Americans. Without a new stimulus package or extensions, millions of Americans will lose their additional $300 to $600 weekly unemployment check.

The euro continues to rise despite the closure of non-essential shops in Germany.Employers will be asked to close workplaces and schoolchildren will be encouraged to stay at home. The country has struggled with the second wave of the virus and lags behind many of its neighbors in keeping infection rates under control.

USD/CAD hit its lowest level in 21/2 years on Thursday before hitting a short-term low on Friday. The pair is heavily oversold and is expected to experience a stronger recovery. The New Zealand dollar also fell despite stronger activity in the services sector. The Australian dollar, on the other hand, maintained its gains.

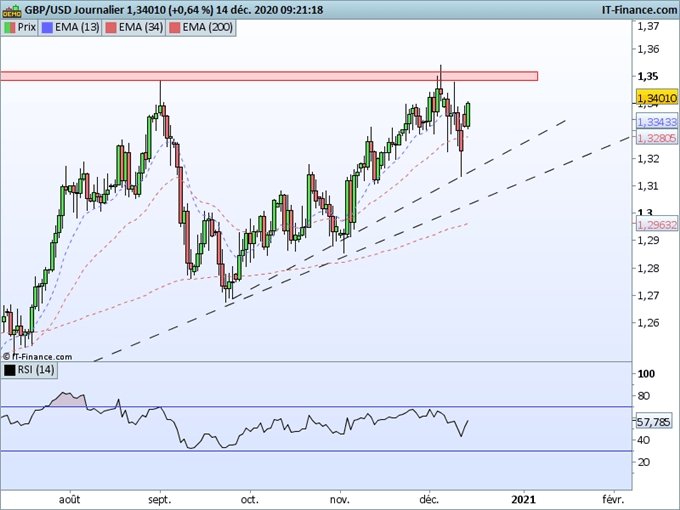

TODAY'S CURRENCY: GBP/USD: REBOUND ON THE BULLISH OBLIQUE

The pound against the dollar is rising again this morning welcoming the continuation of negotiations. The bullish oblique on Friday played its support role perfectly and stopped the correction installed in recent days. However, to confirm the continuation of its rise the pound will have to cross the strong resistance zone around 1. In the meantime we will remain neutral.

A break in the oblique would be a bearish signal with first target 1.2850.

Evolution of the prices of the pound against the dollar in daily data:

Vous devez être membre pour ajouter un commentaire.

Vous êtes déjà membre ?

Connectez-vous

Pas encore membre ?

Devenez membre gratuitement

16/06/2923 - Indice/Marchés

06/03/2026 - Indice/Marchés

06/03/2026 - Indice/Marchés

05/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

04/03/2026 - Indice/Marchés

03/03/2026 - Indice/Marchés

16/06/2923 - Indice/Marchés

06/03/2026 - Indice/Marchés

06/03/2026 - Indice/Marchés